By Terje Osmundsen, Founder and CEO, Empower New Energy

Africa’s share of solar PV investments dropped to 0,4 percent in 2021 and is set to plunge again to about 0,35 percent in 2022.

According to IEAs latest publication “Renewables 2022”. Africa is on the verge of a solar energy revolution, almost quadrupling the total installed PV capacity from 7 to 25 Gigawatt by 2027. Unfortunately, IEA cannot substantiate its optimistic projections. Is this turn-around realistic, or is the continent at risk of becoming the world’s fossil “outlier”?

Let’s look at the actual numbers: The addition of new solar PV in Africa fell from 1,8 GW in 2019 to only 0,7 GW in 2021. In 2022, IEA projects that the world will install 260 GW. AFSIA (Africa Solar Industry Association) estimates that Africa will install about 0,9 GW of solar PV in 2022, which means Africa’s share of new solar PV capacity dropped further this year to about 0,35 percent in 2022.

These numbers fall into a wider and alarming pattern: In 2021, a year when renewable investments globally rose 9% to reach an all-time high, Africa’s investments in renewables slipped 35 % to the lowest level since 2011. Of the $434 billion invested globally to build wind, solar, and other clean power projects in 2021, only 0.6% or $2.6 billion went to Africa, the continent representing 17 % of world population [1]

On this backdrop, it’s uplifting to read the optimistic forecast in IEAs recent publication “Renewables 2022”, projecting that Africa the next five years will build three and half time more solar PV capacity than what’s been built so far. According to the flagship IEA report, we have entered a period of “turbocharged” growth in renewables worldwide fueled by energy security concerns and boosted decarbonization incentives in major economies like the US, EU, China and India.

Unfortunately, IEA cannot substantiate its optimistic projections for Africa with reference to sizable government-backed solar and wind programs. Undoubtedly, Africa has the potential to triple or quadruple its solar investments. But to attract and deploy the 4- 5 billion dollar needed annually to deliver this growth, governments and stakeholders must address the barriers that currently discourages solar investments in Africa. If not, Africa will continue to fall behind against the mounting competition for solar investments from US, Europe, China and India, just as it did in 2021 and 2022.

Where in Africa will this “turbo-growth” take place, according to IEA?

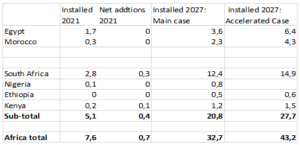

These are numbers I have extracted from the organisation’s website:

IEAs “Renewables 2022”: Actual and forecasted Solar PV capacity in Africa (Gigawatt)

The table shows that Egypt and South Africa has attracted approximately 60% of all solar PV installed in Africa so far. This is mainly the result of two large successful renewable energy programs, REIPP in South Africa and the Ben-Ban solar PV park in Aswan in Egypt.

The next five years, IEA estimates that Egypt, Morocco, Nigeria, Kenya, Ethiopia, and South Africa will grow its solar PV capacity from 5 to 20 GW. The remaining 12 GW of solar PV will come in the other 49 countries where currently only 1,5 GW has been installed.

Why it is so difficult to increase solar investments in Africa? The answer, in short, can be summarised in the three, debt overhang, currency crisis and regulation.

- Debt overhang: Many of the large solar and wind projects that has been announced in Africa the last years remain stalled waiting for the government to issue payment guarantees. Investors and lenders request such guarantees because the utilities company that will buy the power are heavily indebted or in financial distress. But the governments are highly indebted too and has therefore no or very limited capability to issue such payment guarantees.

This situation has now become worse, as Egypt and sub-Saharan Africa are among the hardest hit by the global debt crisis following the pandemic-induced recession, the Ukraine-war, the rise in interest rates and the dramatic fall in local currency values against the dollar. The World Bank estimates that the majority of countries in Africa will suffer from a 30-40 percent increase in yearly debt servicing payments, “The increased liquidity pressures go hand in hand with solvency challenges” warns David Malpass, World Bank president. - The currency crisis: In 2022, the financial position of private and public off takers as well as governments has been further exacerbated by the sharp appreciation of the dollar against most currencies. Among the worst hit are the Egyptian Pound that has depreciated almost 60 % against the USD this year, and the Ghanaian Cedi that fell 110 percent! In Nigeria, the cost of dollar in the parallel market has risen from about 550 to 800 Naira since the beginning of the year.

Whereas richer countries can tap into local funding for renewable investments, Africa is still mostly dependent on foreign investments. International investors generally require revenues in USD or EUR to de-risk their investments, otherwise the cost of capital will be prohibitive. On the other side, energy users hesitate to make long-term commitments pegged hard currencies in fear of a prolonged currency crisis. The result is an effective halt to many renewable investments in Africa. - Regulation and subsidies: According to IEA, the fastest-growing solar PV segments globally are the Commercial and Industrial (C&I) and residential users. The C & I market should also be seen the largest untapped potential for scaling solar in Africa, but regulation and subsidies are holding it back.

Except for South Africa, Nigeria and a couple of other countries, it is still not allowed for manufacturers and other commercial energy-users in Africa to buy solar energy from private providers in the form of Power Purchase Agreements(PPAs). Contracts like equipment-lease can be used, but these do generally not provide the same form of flexibility as PPAs.

The absence of net-metering also a disincentive.Energy-users that has installed solar PV on-site, should be able to export surplus electricity to the grid, and receive credit for that. Finally, subsidized electricity tariffs and fossil fuels penalizes investment in solar and batteries. The cost of diesel in Egypt, for example, is only 7,2 EGP, equal 0,3 USD or is about 20 % of the diesel price in Europe.

Africa clearly has the potential for a turbo-charged growth as projected by IEA.

But if governments and international partners do not address the barriers holding back investments, Africa will continue to fall behind just as it did in 2021 and 2022. This is a risk we cannot take

So, what is needed to reverse the trend and charge a in a turbo growth in solar also as projected by IEA?

Energy reforms, debt restructuring and currency stability are clearly important.

But what really could make a difference is a light market-based “subsidy” on solar and batteries like what exists in the US, Europe and China. This could be in the form of a carbon tax or carbon credit and be an efficient incentive especially for large energy users and microgrids who rely on diesel gensets, replacing them with solar PV and solar-powered batteries. Looking a few years ahead, a carbon offset for decentralized solar in Africa could open a market for locally produced green hydrogen combined with fuel cells for micro-grids and industrial energy users, unlocking an economic revival across Africa fueled by decentralized affordable clean energy.